Welcome to Part 2 of the trilogy on Investingin the stock market for beginners I hope you find this more fun and accessible than the previous one which was more explaining the mechanics of the stock market.

In this I’ll be using examples from Film & Sport I will cover various themes that parallel with investing and life in general. Some of the movie choices are interesting, if you haven’t seen some of them, I highly recommend checking them out.

Enjoy the show!

Let’s go Back to the Future:

Let’s suppose the 3 of us are sitting around in 1975 and I picked 1975 as it’s a nice over 40 year period. It’s also the year Jack Bogle created the first index fund and it happens to be a nice 4 decade chunk of time.

So let’s suppose that 3 of us are all sitting around and having a cup of coffee in 1975 and I say guys I got some news I have a time machine and I just came back from 2015 and I looked back at the next 40 years from 1975 where we are sitting and let me just tell you what’s going to happen because I’ve seen it. I’ve come back from the future!

Where in 1975 inflation is ramping up and it’s kinda ugly and

that’s going to get allot worse by 1980, by the early 80’s you’re

gonna see mortgage rates at over 15% and theirs gonna be this

thing called stag-inflation because not only are we going to have

this outrageous inflation but it’s going to be tied to a stagnant

economy and it’s going to be so bad that in the late 70’s business week (This highly regarded magazine everybody thinks is on top of things) they are gonna run a cover story called death of equities! That’s how bad it’s gonna be for stocks.

In 1982 we had the beginning of the of a Bull Market and that was really nice and it went all the way up to 1987 and then in the fall of 1987 we had Black Monday and on Black Monday the market dropped the biggest percentage in history, right up until 2015 it had never dropped that far. In one day it dropped 25% in one day! It never happened in history before and that triggered this nasty recession that lasted into the early 90’s but then there was this cool technology, I wont tell you about it coz you’ll never believe me sitting here in 1975 some of the technology that’s coming. There was this cool technology and there were companies around then they started going public and there was a big tech boom and people started making money again and around the year 2000 that all collapsed, actually in 1999 that all collapsed and we had what we called the tech crash.

After that there was the biggest attack on US Soil since Pearl Harbour. We got attacked by a foreign enemy and that dragged us into 2 wars like Vietnam that lasted for years in fact when I left in 2015 they were both still going on and we were really making no progress just like in Vietnam and that dragged us down. The good news is after all 911 and the tech boom things started to get better and we had this other little bull run and then these leaders started lending out money without any consideration to the people’s ability to pay it back. This housing market exploded! House prices were going up. It became this great bubble and it burst and collapsed and that created the greatest economic depression or drop since the great depression. I mean the only one we’ve had in the history of the country was the great depression back in 1929. In the 1930’s that’s how bad it was and that lasted for 2 years and by the end of 2009 that started to bottom out and as I got back in my time machine to come back here to 1975 and in 2015 the market had recovered kinda nicely.

So that’s what the next 40 years holds.

Now the other thing that’s just happened in 1975 is this guy Jack Bogle created this index fund where we can invest in the stock market in US,

Question: Who would put all their money in the stock market now?

John Clifton “Jack” Bogle (May 8,1929 – January 16, 2019) was an American investor, business magnate,and philanthropist. He was the founder and chief executive of The Vanguard Group, and is credited with creating the first index fund. An avid investor and money manager himself, he preached investment over speculation, long-term patience over short-term action, and reducing broker fees as much as possible. The ideal investment vehicle for Bogle was a low-cost index fund held over a period of a lifetime with dividends reinvested and purchased with dollar cost averaging.

Jack Bogle is perhaps a legend in the world of finance & investment. He is the founder of the Vanguard group and inventor of the index fund whereby you can invest in not just one company but multiple (in a basket) adding diversification benefits and spreading your risk. Also investing with Vanguard made investing cheaper for everyone due to the way Mr Bogle structured his company.

Why are Vanguard fund fees so low?

Because Vanguard is not owned by outside stockholders as most investment management companies are. Outside investors want returns, and those returns come in the form of fees charged to customers.

Vanguard has no outside investors. The company is owned by its funds, and the funds are owned by their shareholders, which is everyone who invests with Vanguard.

This structure is why Vanguard funds have low fees. Those low fees mean more money in the pockets of Vanguard’s investors/owners.

Speaking of fee’s:

Below is a chart comparing an Annual management charge (AMC) for an amount of 100 pounds and the effect of a charge of say 0.10% (ie rock bottom) vs that of say 3.00% (high).

Of the things you can control in investing: Mainly your choice of fund, the fees you pay and how you handle the taxes. As we’ve seen previously you can’t control the market or predict it and if you can please give me your phone number 🙂

For many of us without an interest in finance or say a job in the finance industry which pushes us more to learn stuff, financial talk can be overwhelming as this was not (at least when I was growing up) taught in school. Big words being thrown around from how charges and fees work to taxes all can sound very complex and confusing. Just like when you hear a financial disclaimer.

Allot of my own knowledge comes from watching personal finance videos on YouTube as well as reading financial books and finance blogs online. Again it’s not everyones cup of Tea and I fully respect that. Like for example I have friends who are really into Cars (Petrol heads) they know how to repair and maintain their cars. I know nothing about cars for this reason I solely rely on my mechanic who is an expert. Obviously if I took more time to learn about cars possibly this could save me more money than hiring a professional mechanic each time I need them but I guess I’m not motivated enough or driven to do this so happy to pay the price.

This can be the same in the financial world where members of the public don’t feel comfortable managing their own finances, pensions etc and they will use an Independent Financial Adviser who like a mechanic will charge a fee for their service.

This is the difference between a D.I.Y investor (manages their own finances) and someone who prefers to use an expert to look after their money. In my opinion no one should care more about your money you’ve earned or saved than you but that doesn’t mean an IFA can’t add value and perhaps give good advice and help steer you in the right direction. My only word of warning is to be careful of fee’s charged and if the funds chosen are right for your personal circumstances. Usually if you’re younger and have decades of investing ahead of you, you can take more risk to get higher rewards. The same would not be the case for someone approaching their retirement date or moving from the Accumulation phase to the Preservation stage.

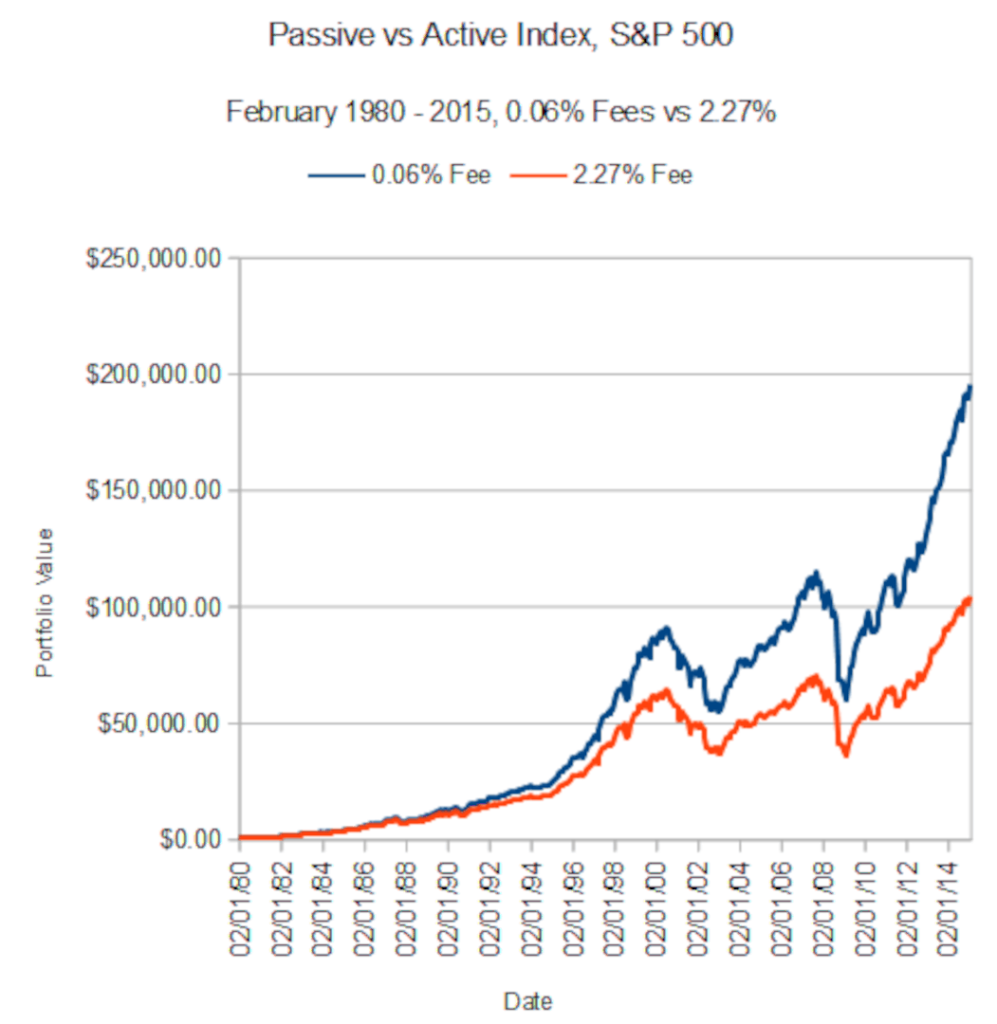

On the topic of Active Vs Passive Investing and which is better. You may notice looking at the fund factsheet’s of various Investment companies fund factsheet’s that there are some funds that are Actively managed and some which are Passive. Only 23% of all active funds topped the average of their passive rivals over the 10-year period ended June 2019.

An Actively managed fund is when a fund advisor makes active decisions on how a fund is invested. An active fund advisor could have a really good year or two record where he has performed very well with a combination of

Active Vs Passive investing:

some skill and a bit of luck and this could lead to great results but obviously there’s no guarantee they will keep it up forever. Also active funds charge more than passive ones so it is something to watch out for.

A passive fund is an investment vehicle that is not actively managed by an investment advisor. Whereby active funds employ people in order to plot to out perform the greater market, passive funds seek to mirror a certain financial sector or index – let’stake the FTSE 100 for an example. By investing in a representative array of FTSE stocks that automatically readjust based on how the components stocks perform, a passive fund will directly follow the performance of the FTSE – which has historically has shown great gains despite occasional drops. Examples of passive funds that you’ve heard of include tracker funds and exchange traded funds, or ETF’s for short (Which are very popular just now).

Please see below chart to the right on how Active Vs Passive stack up against each other. I will always choose passive over Active. There are some active funds that are very good but they cost more, passive funds are generally cheaper and more consistent. The effect fees can have on investment was covered earlier but can be major!

Expectations Vs Reality:

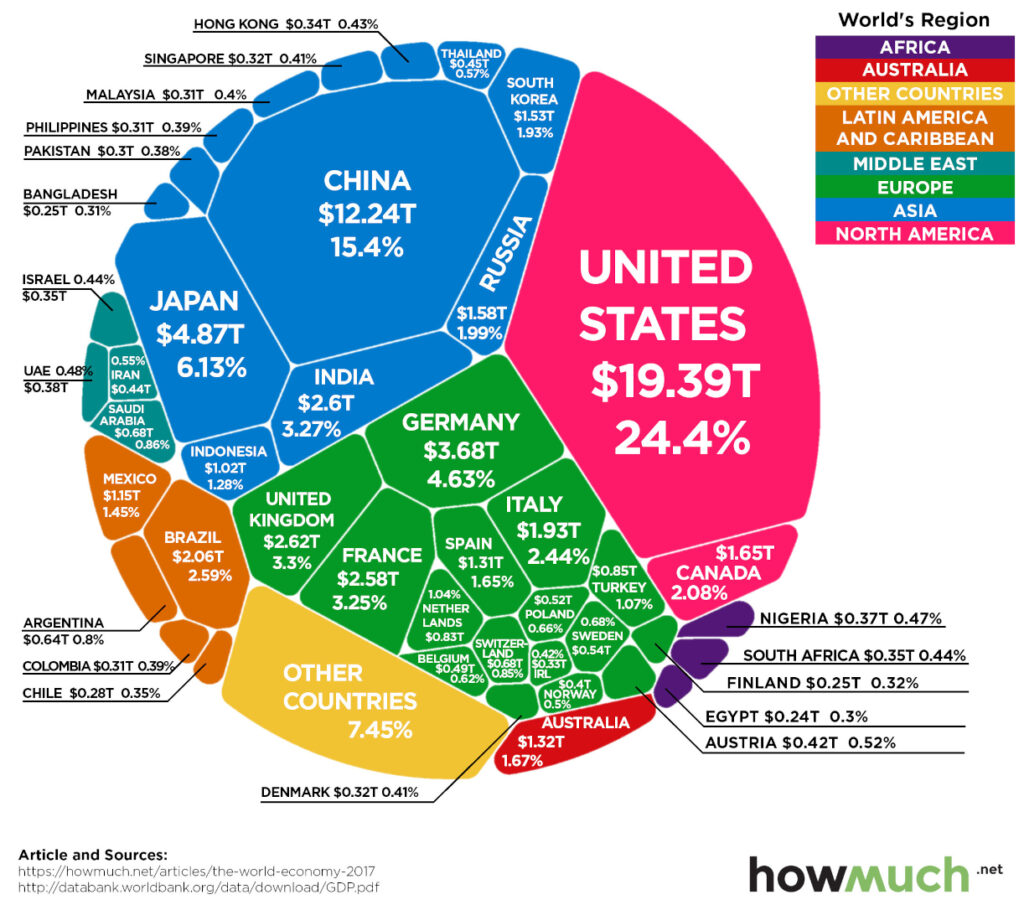

In the movie 500 Days of Summer there is a scene where there is a split screen comparing the expectations of Tom and the reality of Tom. He dates Summer for 500 days and then at some point they break up. Later she returns back into his life and she kindly invites him to a party at her house on the roof. His expectations are high of getting back together with Summer but his reality is unfortunate and devastating for him when at party Summer has clearly moved on and is engaged to someone else (not Tom). This obviously crushes Tom but also explains in investing why nothing is guaranteed. For example if I really believed in Nokia who dominated the mobile phone space when I was growing up that their success would last my expectation would be different from my reality and if I’d invested in them would have lost my money. I personally can’t see Nokia competing with say Apple’s I phone these days but lets get it straight I still wouldn’t feel confident putting all my money in Apple as you never know what’s round the corner. People growing up in previous decades will remember companies like Kodak & Polaroid who were the biggest companies in those days The same can be said of EasyJet as their stock price is very low these days, seems like a bargain. Since the pandemic hit in March 2020 this has effected the travel industry massively and you only have to think of Flybe as a recent example of an airline going out of business. In todays times the Tech companies seem to dominate your Apple, Your Microsoft, Your Google, Your Facebook and Your Netflix (please note all American companies). The hidden secret to investing is not to own one big company but to own them all and not just to own the ones from one country like say America

but from all countries. Why just Ford when you can have Toyota, why just McDonald’s when you can have Nestle. Picking one country is akin to picking one company. You must be diversified. As If you invest only in the UK you will be mainly focusing on the oil and banking sectors and missing out on the technology sector within America and in the emerging markets like China and South Korea.

Fear in life Vs Fear in the market:

With the release of the new cobra kai season 3 it brought back memories of the original 3 Karate Kid (trilogy) movies. I deliberately chose not to include the fourth instalment with Hillary Swank and definitely won’t be including the Jayden Smith and Jackie Chan reboot. Nothing against Jackie Chan but he’s no substitute for the great Mr Miyagi.

One of the themes I wanted to discuss was Fear and this is a regular theme within the original 3 Karate kid movies. The reason I bring this up is Fear can be paralysing, it really can stop you in your tracks and can get you nowhere fast. Allot of Fear can be of the unknown & worrying about the consequences.

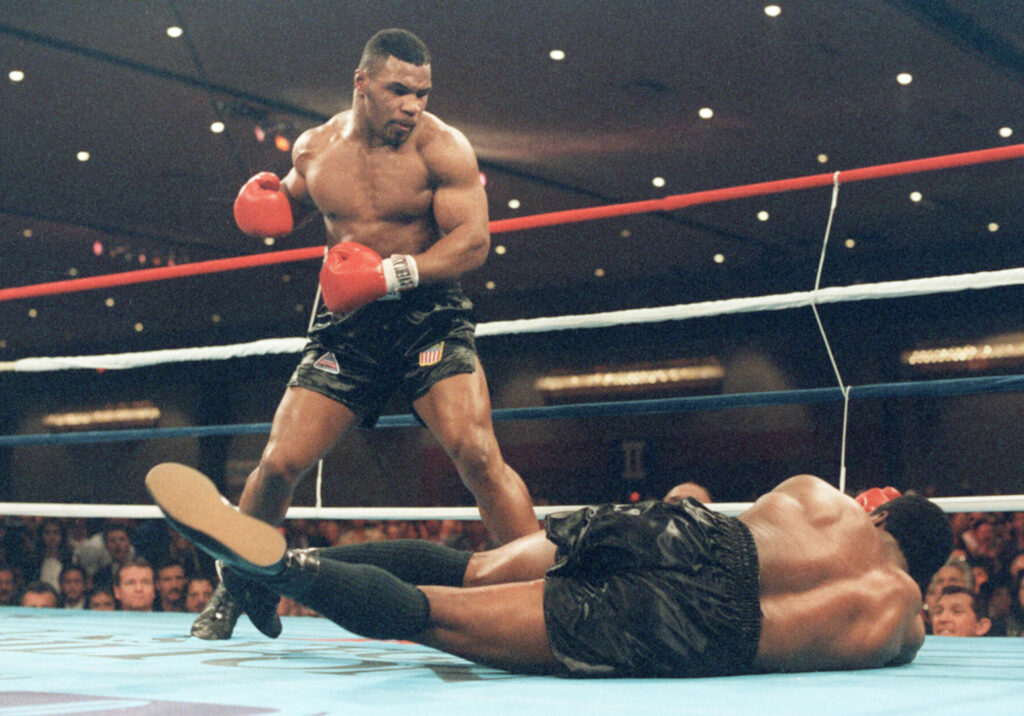

When I was growing up my biggest fear even though I wasn’t a professional boxer (but had an interest in watching the sport) was being forced in the ring with a young Iron Mike Tyson (had reputation for being the baddest man in the planet) and the pain I would feel having to take his punches. Not that I would be able to take many more shots than one before I’d be out of the ring and headed for the infirmary. Many of Mike’s opponent’s were beaten before the first bell, a good saying was many of his opponents had one foot in the ring and one foot out of the ring.

I was once asked a question by a Boxing fanatic family friend why Michael Tyson was the youngest heavyweight champion and such a great fighter? To which I replied because he hit’s very hard and knocks you to high heavens. I was told no that’s not the reason for his success it’s because he studies his opponents. Maybe taking some time to study can improve your chances at being successful in Investing your savings and set you up for a bright future.

Anyway going back to Karate Kid trilogy I’ll try and sum up part 1 & 2 just in case you’ve never seen them (if you haven’t their on amazon prime just now) as there are some story line connections to 3:

Daniel Larusso and his mother relocate to California and being the new kid in town or at school Daniel finds himself being bullied by a gang of boys at school who later turn out to be Karate students of a local dojo. Daniel during the course of the movie meets Mr Miyagi a Japanese maintenance man (Jack of all trades) at his apartment complex and later discovers Mr Miyagi knows Karate and he offers to teach Daniel but only for self defence purposes. Mr Miyagi’s only exception is that the karate gang stays away from Daniel until the penultimate all valley karate kid competition at the end. In overcoming his bully Johnny Lawrence in the final of the tournament using the famous Crane Kick.

In Short part 2: was when Daniel & Miyagi travel to Okinawa, Japan and once again Daniel must overcome a fearsome opponent in Chosen the Grandson of Sato (Mr Miyagi’s childhood friend who he betrayed with a common love interest)

Moving onto Part 3 which I’m going to base this on. Part 3 has connections to the end of Part 1 where after the tournament the instructor john creese losing his pupils by throwing a crazy tantrum in the car park and Mr Miyagi makes his hands bleed by dodging his punches and his hands going through the glass window of a car. John Creese ready to give up the keys to his dojo to his rich wealthy and manipulative Vietnam war friend Terry Silver (Who creese saved his life during the war) is convinced to take a vacation to Hawaii while Terry Silver devices a plan to get revenge on Daniel & Mr Miyagi for his friend Kreese.

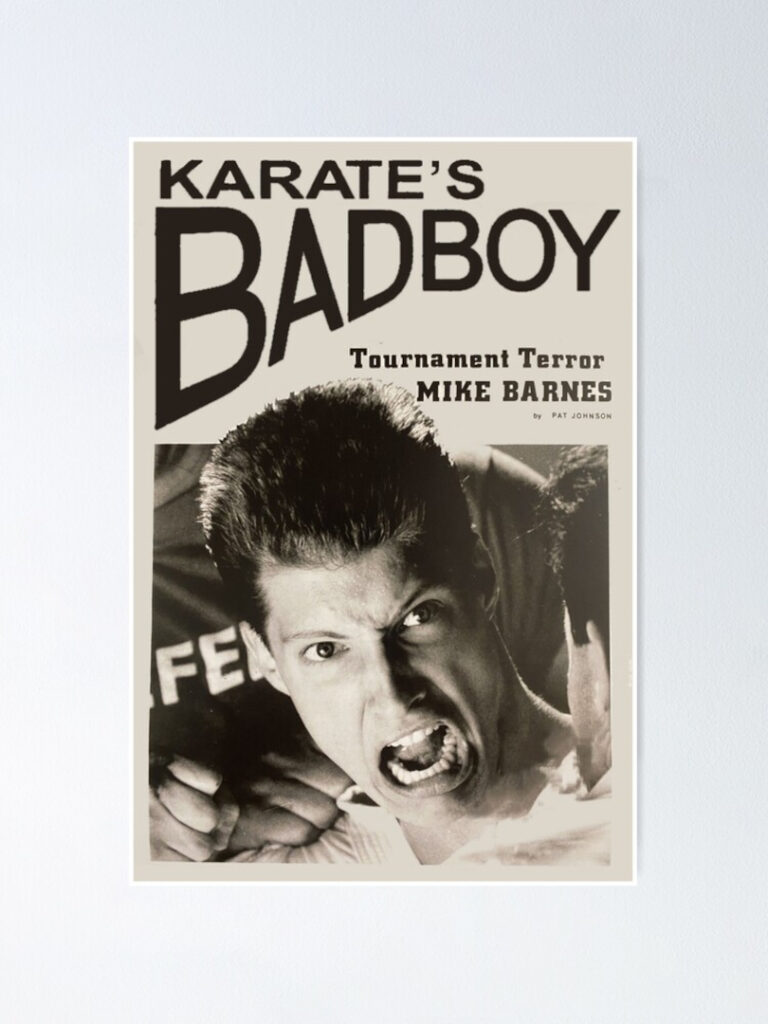

Terry Silver befriends Daniel while simultaneously hiring Mike Barnes (Karate’s Bad Boy) to force again by the means of bullying Daniel to enter the all valley tournament for a 2nd time. This years rules are diff and the defending champion only has to fight in the final. Larusso is tempted to fight in the tournament again because of his ego but Mr Miyagi is not on board this time. So Terry Silver trains Daniel behind Mr Miyagi’s back and is giving him bad advice and effectively setting him up. There is even a scene were before a training session Daniel is warming up using kata to which terry silver says “Kata won’t win tournament’s”.

In the behind the scenes of the film it has been said that Mike Barnes the villain was kept away from Daniel Larusso during the filming this was to create more fear as if they were allowed to be buddies off set it would have shown in the film and they thought better to keep them apart.

Anyway before the final tournament which Daniel is forced into entering long story short it was a life and death thing.

After training with Terry silver, Daniel once again tries to opt out of the tournament. Terry Silver is not happy and Daniels asks why to which Terry Silver reply “Nothings for free” he then reveals his true agenda and the secret of being a friend of Kreese and having hired Mike Barnes to get revenge.

During the final fight against Mike Barnes who’s been asked by terry silver to deliver pain to Daniel by winning a point losing point for violations there’s a point in the fight where Daniel is on the floor in lots of pain with fear in his eyes like a Deer in headlights.

Mr. Miyagi:

To quote the movie:

Daniel-san! Daniel-san!

Daniel Larusso:

Mr. Miyagi, it’s over! It’s over, Forget about it!

Mr. Miyagi:

No… No!

Daniel Larusso:

I’m afraid! Let’s get out of here, I wanna go home!

Mr. Miyagi:

Cannot, must not! It’s OK lose to opponent! Must not lose to fear!

Daniel Larusso:

But I’m afraid! I’m afraid of him! What am I supposed to do?

Mr. Miyagi:

OY-OY… OY-OY… OY! You stay focused. Daniel-san, you best karate still inside you! Now time let out!

After much thinking over on what Mr Miyagi said about it being OK to lose to opponent but must not lose to fear, Daniel rises full of confidence and first bows to Mr Miyagi as a sign of respect & the referee and goes on to use the Kata technique which you’ll recall Terry Silver had said earlier never wins fights, but it sure did this time.

I guess the point I’m trying to make is overcoming fear comes from inside and allot of the time it’s the difference between thinking and knowing. You often hear the saying don’t over think it. Through-out the movie Daniel is trying to re-invent the wheel through learning sweep techniques from his (unknown until the near the end) arch rival instead of focusing on his best Karate which is inside him already.

To compare this to investing realising you can’t beat the market but you can invest passively and grab yourself a share of the average of the market and this can be done using one fund that invests globally and perhaps a second fund using your local/national Gov bonds and adjust between to suit your personal risk levels/appetite.

Lets move from a Karate tournament to a Golf tournament which best explains the true value of investing globally.

Investing using parallels of Golf

So a new Golf tournament has begun at St. Andrews the home of Golf. This tournament will be known as the Pension Way Super Cup!

The top 5 players involved are legendary current players, former champions, and a special guest who considers himself a great Golfer:

1. Tiger Woods, USA.

2. Rory McIlroy, Ireland.

3. Jack Nicklaus, USA.

4. Tom Morris, Scotland.

5. President Trump, USA.

Now you’ll notice that 3 out of the 5 players are from the USA. I would say picking a player from USA would maybe give you a better chance a 3 in 5 chance but if you also consider that Trump is not a professional Golfer than this gets much more even. As You’ll now have 2 Pro’s from UK/Europe and 2 Pro’s from USA and 1 Amateur player in President Trump.

Now I could also pick a winner based on recent form or youth in Rory McIlroy or because he’s Irish!

I could also pick Tiger woods based on historical achievements and reputation as one of the greatest Golfers. Past performance is no guarantee of future success in investing!

Also you could like the chances of Old Tom Morris from a completely different era and would have had to time travel to this new event. He would be a very experienced campaigner and he’s a Scot!

I could like the chances of the underdog in Donald Trump, I mean if the Pro’s have an off day he could pip them to the post. After all he won the US presidential election campaign, anything is possible.

Picking an individual winner will always be tough and high risk. What if we turned the tournament into a US Vs Europe tournament?

We could get the USA Ryder Cup Team Vs the European Ryder Cup Team The European Team:

The USA Team

The European Team

Now we have 2 teams with a variety of players with allot of national pride, determination to win, different strengths and weakness’s.

Now the options are getting simpler as we are down to 2 choices. Europe Vs USA. 50/50.

Now you might feel that Europe is home and you could have a home bias. Home bias in investing may be risky as in the UK we are only 6% of the Global GDP whereby USA is currently 60%.

You might just think the Americans are so tough, hardworking and fierce and good at most sports. You might know the players better having heard the name Tiger Woods repeatedly in the mainstream media and even from you’re own dad. (My dad is a big Tiger Woods fan!) Media will report stories about things going on in the market, sometimes related to their sponsors which can influence you to make decisions not always in your own best interest. Even our own parents or friends can influence us with their own thoughts, opinions and experiences. Like someone who grew up during the 1930’s and lived through the depression may not ibe keen investing in the stock market and prefer to keep their money in the bank as cash or buy physical Gold to be held in a Vault.

How about If there was an easier option to pick a winner by combining the European team with the American team and creating a global team. This brings the benefit of global diversification, a move away from home bias, no longer only investing in the UK or Europe. No this not cheating, It’s a wise move.

I’ll finish on a quote from a podcast interview on Chat with Traders with John Rambo Moulton, a USA born, bonds investor living in Sydney, Australia. In the quote he is referring to Jack Niklaus commentating on a Golf tournament about the winning player Hailerman.

“I think Golf is very similar to trading, one sport that draws allot of parallels to trading and he said the following he was talking about Hailerman who was another Golfer from his era he was receiving a big prize and when he referred, he said Hailerman is a great manager of himself and the course the analogy here is that a Golf course is like the market. When you Tee up on the 1st Tee what are you up against? What are you up against? How are you going to swing the club? What are you thinking in your head? How am I going to play today? Internal. The course? How’s the wind blowing? How fast are the greens? How thick is the rough? That’s the marketplace. That’s what you have to deal with. When a professional golfer Tees off that’s what he has to deal with not only himself but the Golf course. Every time you turn that machine on you have to deal with yourself and you have to deal with the market. Very close Parallels, anyway he said Hailerman is a great manager of himself and the course and then he just said this to anyone that wanted to hear it. Know who you are, know your game, play within yourself. I wrote it down because this is trading and he said believe in yourself and I’ve already said this to you guys. Another thing he said that I found really fascinating and he’s the greatest Golfer ever, he’s dominated the sport during his era and he said I never thought I was the best. If I ever started thinking that way. I was absolutely destined to mess up. Triple bogey, lose the tournament, not make the cut so I never thought about being the best to me it was always the challenge to be the best. I thought that was interesting.

For your info if the tournament went ahead with individual players Jack Niklaus would have probably won particularly with his mindset. Although you are much better playing as a team and being global. I’ve never watched Golf or never played on a Golf course but this quote inspired me to put this together. Wish it was more in depth as I know very little about this game.

Conclusion/Key Takeaways:

Knowledge is power.

Fear can be overcome.

Have realistic expectations as your reality might be different.

Active Vs Passive remember the differences.

Fee’s, Fee’s, Fee’s watch out for them.

Investing globally is the key.

The End.

Hope you enjoyed this entertaining way to learn about Investing through lessons in Movies and Sport.

Put together by Pension Way with the help and the great work of the below sources:

References:

JL Collins Stock Series https://jlcollinsnh.com

Choose FI Podcast https://www.choosefi.com

Vanguard https://www.vanguardinvestor.co.uk

Monevator Blog UK https://monevator.com

Bogleheads Forum https://www.bogleheads.org/forum/index.php

Lars Kroijer https://www.kroijer.com