In this Part 1 of a trilogy investing in the stock market for beginners I will cover how the market works and why you should get serious and excited about investing so you can have more freedom and a richer life.

The stock market is a place where you can buy and sell assets. It is the greatest wealth building machine! All you have to do is regularly contribute through your pension and the market will give you a return. If you are consistent and dedicated and we’ll behaved long term you will do very well.

Here are the two most common assets:

Stocks/Equities:

When you own stock you own a piece of a business. These are companies filled with people working relentlessly to expand and serve their customer base. They are competing in an unforgiving environment that rewards those who can make it happen and discards those who can’t. It is this intense dynamic that make stocks and the companies they represent the most powerful and successful investment class in history. – JL Collins.

You can choose to buy individual stocks in companies like Apple or Microsoft or even Flybe. This could be considered to be risky. Who knows if Apple or Microsoft will be here in the future? No guarantees. If years earlier, you thought the low cost airline Flybe would still be here and you put all your money into them, you would have lost everything today.

This is why the best, simplest and safest way to own stocks is in a Stock index. An index can be the FTSE 100 (Top 100 UK companies like Diageo, Vodafone and BP) or the S&P 500 (Top 500 USA companies like Apple, Microsoft and Google). An index is a basket of stocks, 100’s & 1000’s of companies across many different sectors and geographies. Investing in a Stock index provides diversification.

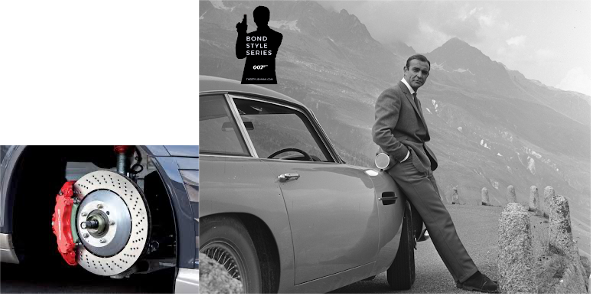

Stocks can provide great growth to your portfolio but can also be very volatile. It can be a bumpy ride. So make sure you wear a seatbelt!

I refer to the stock part of the portfolio as the engine of a car.

Bonds:

A bond is an IOU.Those who buy such bonds are, put simply, loaning money to the issuer for a fixed period of time. At the end of that period, the value of the bond is repaid. Investors also receive a pre-determined interest rate (the coupon) – usually paid annually. Bonds are usually safer and less volatile than Stocks

Bonds are in our portfolio to provide a deflation hedge. Deflation is one of the two big macro risks to your money. Inflation is the other.Bonds also tend to be less volatile than stocks and they serve to make our investment road a bit smoother. Plus they earn interest.

In this current environment short-term bonds (Less risky) are paying next to nothing. Long-term bonds (High risk) will get hit hard when inflation reignites. Intermediate bonds (medium risk) pay a decent interest rate and their term makes them less vulnerable than long bonds to inflation.

I refer to the Bond part of the portfolio as the breaks of a car.

Other assets include: Gold, REIT’s (Real Estate Investment Trusts) and Cash.

The traditional vanilla way to invest is usually a mix of Stocks and Bonds.

Only Stocks:

You could invest purely in stocks if you are young (and in your 20’s

After the markets crashed back in 2008 if you had put any amount of money in the S&P 500 USA stock index you’re money would have tripled 10 years later by 2018.

Only Bonds:

Of course you could purely invest in Bonds if you are very risk adverse but currently bonds are offering negative yields you may get the money back you invested but it may not grow very much. Just to add there have been times in history that bonds have paid 7% to 9%, just like investing in Gold there have been times in history where it has been the best place to invest your hard earned money. Just like property in London and Edinburgh always seems to do really well so far but in places like Florida and Las Vegas not always so.

Earlier I mentioned:

I refer to the stock part of the portfolio as the engine of a car.

I refer to the Bond part of the portfolio as the breaks of a car.

A fast car, needs breaks or else it will eventually crash. So therefore combining the stock asset and the bond asset you have a more reliable, efficient vehicle (think Japanese or German cars).

So now you have 2 funds one high risk (Stock fund) and the other the lowest risk asset (A UK Government Bond Fund) available.

Asset Allocation:

Asset allocation is when you decide which percentage of each asset you would like to put together or blend.

Examples can be:

50% Stocks – 50% Bonds (Low risk)

75% Stocks – 25% Bonds (Medium risk)

90% stocks – 10% Bonds (Higher risk)

Diversification:

Diversification is achieved by investing globally as this will give you exposure to different countries who may be doing well like the biggest market in the world USA or S.Korea as well as covering different sectors like banking, oil, technology and medical. If you choose to invest exclusively in the UK you are putting a bet on the UK economy doing well. So therefore all your money is invested in the UK. Your job is in the UK, your mortgage is in the UK, if everything falls apart in the UK you could be in trouble. This is why it makes sense to invest globally. Also being in one asset like stocks is a heavy bet on one asset class always doing well, adding bonds can help you diversify or even adding Gold.

The different phases of retirement savings:

Accumulation phase: Is when you are at the stage of life when you are working and saving into your pension. Market crashes and dips in the market benefit the accumulator as you are buying stocks on sale prices and eventually they go up over time. This can be known as ‘buying low now and selling high at some time in the future’. Also every month you consistently invest in the market through the ups and downs you are doing whats known as pound cost averaging. Some months or years stocks are high, some are low you are buying units at different times, different prices. Timing the market is futile, time in the market is better than timing the market.

Preservation stage: When you are in retirement and want to preserve your wealth to either make your money last through retirement or pass on your wealth to a family member or children, we’ll call this legacy wealth. You could take an annuity which is a secured income for life or go the route of Flexi-access drawdown whereby you draw on your assets like withdrawing money from a savings account over time. Usually in the preservation stage you will hold more bonds as these are safer and provide regular interest payments and your portfolio ride will be smoother as you don’t need any unnecessary financial stress at this stage in your life.

The different ways to invest in a Pension:

The D.I.Y investor picks his own index funds or ETF’s. He may really like Japan so he buys Japanese stock index. Or he may want only to invest in developed markets or buy into emerging markets like the BRIC economies of Brazil Russia India China. They may avoid the UK stock index because of fears of Brexit.

Target date retirement plans are when you pick your retirement date say 2045 and the fund may start off more aggressive (heavy in stocks) but over time will increase the bond allocation particularly the nearer you get to your selected retirement date. These are set it and forget it plans. Generally allot safer and risk free Vs a DIY investing strategy.

Lifestrategy plans are when you pick your preferred fixed allocation and the funds are auto rebalanced to keep your desired allocation. So If you choose 80% stocks to 20% Bonds your portfolio will remain that way and there will be no drift.

Finally and most importantly watch the fee’s:

Why do costs matter?

Investment costs might not seem like a big deal, but they add up, compounding along with your investment returns. In other words, you don’t just lose the tiny amount of fees you pay—you also lose all the growth that money might have had for years into the future.

Imagine you have £100,000 invested. If the account earned 6% a year for the next 25 years and had no costs or fees, you’d end up with about £430,000.

If, on the other hand, you paid 2% a year in costs, after 25 years you’d only have about £260,000.

That’s right: The 2% you paid every year would wipe out almost 40% of your final account value. 2% doesn’t sound so small anymore, does it?

I hope this helps go some way to demystify pension investing and the stock market.

Put together by Pension way with the help and the great work of the below sources:

References:

JL Collins Stock Series https://jlcollinsnh.com

Vanguard https://www.vanguardinvestor.co.uk

Monevator Blog UK https://monevator.com

Bogleheads Forum https://www.bogleheads.org/forum/

Lars Kroijer https://www.kroijer.com