“So that the record of history is absolutely crystal clear. That there is no alternative way, so far discovered, of improving the lot of the ordinary people that can hold a candle to the productive activities that are unleashed by a free enterprise system.” – Milton Friedman Economic Economist

Falling for the Hype

In today’s world we are inundated by finance news & speculation in the mainstream media as well as by owners of large companies, celebrities & Finance YouTube influencers hyping up the latest crypto currency which is definitely going to the moon, no doubt!

There is also plenty of finance forums on reddit to get lost in (rabbit holes)and plenty of personal finance YouTube channels & finance books to influence and inspire us on how to invest and what to invest in. Also these days the ease of starting to invest is effortless, from instantly being able to download an application on our smartphones. it’s never been an easier & faster time to start investing.

Investing in crypto because your friends or work colleagues or mate of a mate (friend of a friend ya ken?) do and you heard it could make you super rich fast (overnight even) without really doing your own research or understanding the technology behind it is akin to learning to drive a car and having 1 lesson then taking to the motorway on your own. Another way to put it is having one karate lesson and challenging your black belt sensei to a fight. Unlikely to end well. About 95% of Crypto alt coins are pump and dump. There’s a good chance you will lose all your money. Not just crypto but even investing in single companies instead of an (index fund) a basket of companies there is so much concentrated risk. Sure the company could be cruising/ flying highI.e Tesla & Apple but no one knows what the future holds. I always go back to Nokia phones (see historical performance chart below)when I was growing up they were huge and if you ever forgot your charger there was always countless people with a Nokia one to borrow. Today Nokia is not the company it once was. The same can be said for blackberry. Who would have thought Apple a computer company would dominate the phone market today.

Another point I wanted to make is that there are so many finance guru/furu get rich quick seminars out there where members of the public get fooled and part with their hard earned cash or get into debt & get nothing out of it that they couldn’t have got from a free book down at the local Edinburgh library or an internet search. Some of these seminars aren’t even live but our pre-recorded online pretending to be going live from say Chicago or somewhere.

Also pension scams are really devastating where someone loses their life savings to a con man with promises of better investment returns. Pensions can be like the wild west hence the importance of Pension liberation checks and proper due diligence before transferring Pension Pots to risky places.

The Nifty Fifty

The Nifty Fifty was a group of 50 stocks identified by market commentators, although itwas never an official benchmark index.The companies shared similar characteristics: high quality franchises benefitting from surging economic growth and strong balance sheets. Delivering healthy profits and good returns for investors year after year, they came to trade on very high valuations. The group included Revlon, Procter & Gamble, Philip Morris, Pepsi, Pfizer, Merck & Co, Eli Lilly, Coca-Cola, IBM, Gillette, Wal-Mart, Disney, Eastman-Kodak and Polaroid. Certain sectors were particularly well represented, including consumer, healthcare and technology. Many are still household-names today, although some, like Eastman- Kodak, have disappeared.It was said by many investors at the time that Nifty Fifty stocks should be bought and never sold. By the early 1970s they had become the darlings of many institutional investors and staples of their portfolios.

Many of the above companies in this nifty fifty index are still around possibly because they are so good at what they do and have not dropped out due to their competitors. Some companies have periods they do well and times they lose their way or even go out of business. Apple is an example of this if you know the story of Steve Jobs being fired from his own company a short 9 years after starting it and returning and bringing it back to prominence and even Microsoft Once upon a time, Microsoft dominated the tech industry; indeed, it was the wealthiest corporation in the world. But since 2000, as Apple, Google, and Facebook whizzed by, it has fallen flat in every arena it entered: e-books, music, search, social networking, etc.,. The stock market is a reflection of this when the value of a company rises and falls, falls and rises. There is no guarantee a line on a chart has to always go up. Although a line going down can provide good buying opportunities as you get to buy the company cheaper and hopefully enjoy the ride upwards to profit. This is referred to as buying cheap and selling high. The beauty of owning an index fund (my preferred option) is that you get the growth of the companies going from small companies to goliaths and the companies that fail and leave the index get replaced by the next up and coming company. It’s automatic self cleansing just keep buying and holding.

There are various ways to invest but the three most common ways are through a workplace pension or a SIPP, an investment ISA or via a rental property.

Pension/Sipp

Pros – Our money goes in pre-tax you avoid paying tax today (and NI with salary sacrifice) to pay it possibly someday in the future. You may be able to to use flexible access to control your withdrawals and your tax rates. More money gets invested and has a longer time to compound.

Employers matching your contrition can help double your money giving you a rate of return of 100%. Lets say you put in £50 you then get £50 from the company = £100. No better return on your money anywhere compares. You should never turn down free money and you should remember this is part of your overall salary package. Many people don’t even take advantage of this which is a real shame. This is like walking down Princes Street in Edinburgh and walking past several 50 pound notes dropped on the street & not giving them a second look.

Protection from creditor’s.

Inheritance tax free – can be passed to loved ones if you pass away (before age 75) *Sorry the pro’s are endless and I personally think pensions are great but they are subject to government meddling.

Cons – Restrictive access starts at age 55 or 57 (after 2028) or possibly 60 for women with GMP (Defined Benefit) and 65 for men with GMP (Defined Benefit). This is because this money is meant for old age when we no longer have a job. If not a very disciplined saver this could be a pro as you will not be able to break the piggybank to go on a big night out 🙂

Where are tax rates going? Will they be higher in the future? Government moving goal posts & changing rules.

ISA (Stocks & Shares investment)

Pros – Our money goes in after tax ie after we get our wage which has been hit by tax and NI. Money grows tax free and you never need to pay tax again! Possibly wider range of investments available from Gold to Property funds. Liquidity for example if you hold exchange traded funds you can sell out for cash and transfer to your bank account very quickly. Index funds/Mutual funds may take a little longer to sell and recoup the cash but still within a few days you’ll have the cash.

Cons – May be tempted to break the piggybank due to being instantly accessible to go buy a the latest Iphone or another meal out or holiday. I’ve fallen prey to this myself hence totally relate and love the lock up for this very reason – human behaviour.

Property

Pros – Houses (usually) go up in value (appreciates), you get monthly rent that covers your buy to let mortgage and may provide extra cashflow. When house mortgage is finally paid off all the rent money accept for repairs is yours.

Cons – Bad tenants, Vacancies, Calls at 3am in the morning to come and fix the boiler. Repairs, Replacing washing machines the list goes on. Always on the phone, not a very passive way to earn extra income. Could feel like a liability.

The Supermarket to buy investments

The stock market is like a giant supermarket allows you to purchase various shares, funds & investments. You can invest in pretty much anything locally or globally.

Vehicles:

These can be Workplace Pensions, Self invested Personal pension, Investment ISA’s, Life time ISA’s, Cash ISA’s. These can also be known as a wrapper. If you think of a pension your money is protected from tax but the second you remove the coat/wrapper go into a withdrawal/drawdown it’s subject to tax. In an ISA you pay no tax on the growth of your investments it is treated as tax free so is protected within this wrapper/coat.

Platforms:

There are various platforms/brokers that allow us to buy individual shares, index funds/ETF’s etc.

Using the supermarket analogy above I will give a few examples:

Hargreaves Lansdowne is like Waitrose. Hargreaves Lansdowne is considered expensive but has good customer service, good website and detailed phone app. Also has a huge selection of external funds as well as their own.

–

Iweb (owned by Halifax) is like Aldi or Lidl.

Iweb’s website looks like it hasn’t been updated since

the 80’s, they don’t have a phone app and their

customer service is hit & miss. Iweb has a big range of

external funds and is considered good value for money but not very flash.

–

Vanguard (owned by the investors) is like a local farm.

Vanguard focuses on offering low cost investing to help

it’s investor’s/owners do well long term. Vanguard’s

website while simple only offers Vanguard’s own funds

and ETF’s. Something like 77 funds, so you are quite

limited in what you can invest in but this may helpkeep your investing portfolio simple, just like the food at the local farm is organic, healthy & unprocessed.

Types of investments:

Indexed Mutual funds – John Bogle was the founder of the Vanguard Group and a major proponent of index investing. Commonly referred to as “Jack,” Bogle revolutionized the mutual fund world by creating index investing, which allows investors to buy mutual funds that track the broader market.

Mutual funds are priced once a day usually around 9pm (when market is closed) and they can take a day or two to execute a purchase or sale due to forward pricing. This prevents market timing as your guess is as good as mine as to what tomorrows prices will be but if you know please be sure to give me a call 🙂

Exchange Traded Funds – In 1990, one idea was postulated and acted upon by a Los Angeles-based investment firm Leland, O’Brien and Rubinstein (LOR) that stocks could be grouped together into a basket, placed on an exchange, and traded as a single unit.

Exchange Traded funds are instant to trade in and out of during the hours the London Stock Exchange is open. I personally think due to their popularity they will probably replace mutual funds in the future as they are quicker to buy and sell, low cost, tax efficient and are very liquid.

Individual Company Shares – Italian companies were also the first to issue shares. Companies in England and the Low Countries followed in the 16th century. Around this time, a joint stock company—one whose stock is owned jointly by the shareholders— emerged and became important for colonization of what Europeans called the “New World”.

Buying individual companies will always be popular even though it’s extremely risky. They’ll always be someone who thinks they can beat the market or has an edge be it a individual investor or a hedge-fund or active manager. There is allot of people who like dividend investing these days so they own multiple companies from different geographical locations/sectors and collect the dividends, but dividends can get cut I still prefer to own an index as it’s much less riskier that you’ll lose all your money or your dividends can get cut.

Three things to be wary of in investing:

1. Individual stocks.

Seeing as Christmas is coming, I figured this would be a good way to get the message over about the high risk of owning individual companies no matter what your conviction is: Imagine the life of a Turkey in a farm. The Turkey is given shelter and is kept warm throughout the year. The Turkeys feeds are given frequently throughout each day like clock-work by the Farmer. From January to November everything is going so well, the Turkey feels so lucky. The farmer is really taking good care of him. Unfortunately and you’ve probably guessed it was coming, one day in December the farmer decides it’s time to sell the Turkey to someone for Christmas Dinner. The Turkeys luck has run out. The reason I’ve used this story is that a stock can be doing really well through the year/s paying good dividends and with good growth but one day the company could just close or go bankrupt and you will lose everything you’ve invested in the company. Real risk is the permanent loss of capital…its where something goes down and it ain’t going back up again. Like The Titanic for example. Investors in P2P Lending are like turkeys on a farm. They get fed…until the game changes.

2. Inflation.

Most people prefer to keep cash under the mattress or in a cash ISA or their savings account. It is OK if you aresaving for a short term goal like house deposit or weddingsay 1 – 5 years away. This money is not worth risking in the market. If you hold too much cash many people think

this is safer than the stock market. Wrong. Your cash is like an ice sculpture at a wedding after party. You can’t see it melting away… but is is. Inflation guarantees that your cash will lose its purchasing power over the long term. In my wife’s country Venezuela they have runaway inflation. Over there when making a trip to the supermarket whilst queuing up the price of the goods can go up while you are waiting as prices are changing all the time. Venezuela is also the most expensive place to eat McDonalds in the world. Can’t really understand why they still do business over there as there is other latin countries they have left behind like Bolivia. Many will know that even though McDonalds are mainly known for hamburgers/fast food but the founder was a big fan of real estate maybe they don’t want to lose their prime locations around the world in case politically things improve some day. Note: Gold and stocks act as an inflationary hedge.

3. Deflation.

Deflation is when consumer and asset prices decrease over time, and purchasing power increases. Essentially, you can buy more goods or services tomorrow with the same amount of money you have today. This is the mirror image of inflation, which is the gradual increase in prices across the economy. Just imagine you’ve saved up for ages to buy a new 55 inch Sony/LG or Panasonic OLED TV. You head into John Lewis to purchase it knowing you get your 5 year guarantee if anything goes wrong as well as expert customer service. The day you head in the TV is valued at £1,500 but you hear from a John Lewis partner who’s helping you that it was £1,600 just the day before and it may get even cheaper if you wait another day. This will make you put off the purchase even though you really want the TV because who doesn’t like a deal? This scenario is quite unique though as john Lewis have a 28 day price match so potentially you could pay the £1,500 and if you see the price drop within 28 days you could get the difference back by submitting a price match claim – sorted! If it had been any other store you may have just played the waiting game. You’ll prob understand now that some inflation is good in our economy it’s grease for the wheels. Deflation can be so ugly as can too much inflation.

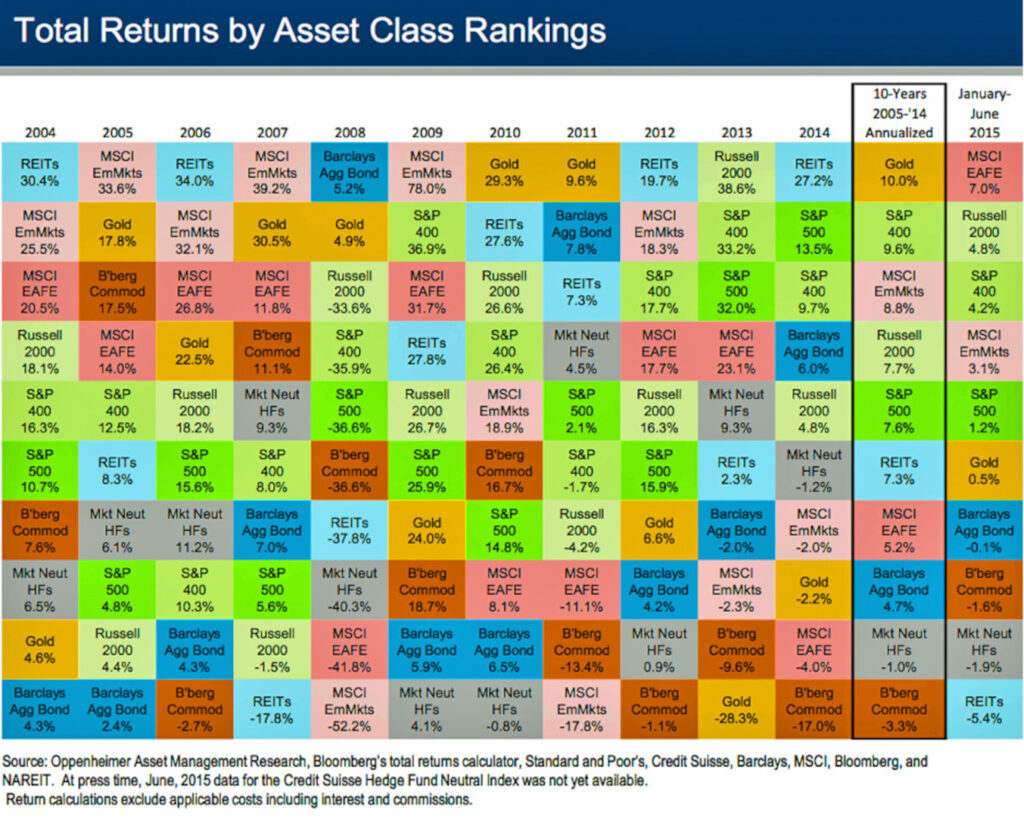

The Historical Returns by Asset Class Over the Last Decade:

This chart gives you an idea that no one asset is perfect and they all have good and bad years. Typically stocks have the highest potential growth over the long term.

These days (at the time of posting at least) Bonds are doing poorly and if inflation gets any higher they could do even worse.

Portfolio’s

The Permanent portfolio

The first ever portfolio construction that caught my eye, the beauty and simplicity of it was the permanent portfolio created by Harry Browne a famous American Libertarian.

The idea of the portfolio was that whatever the market was doing you weren’t concentrating your bets in one asset class like say only holding stocks. Say one or two of the assets were doing poorly the other two would be crushing it to prop the overall portfolio up. As there was four parts to the portfolio cash, gold, national stocks & long term bonds. I guess the general idea of the portfolio was that say the Gold preppers in the states were right that if the

financial system collapsed you would be better off holding Gold you’d be doing OK as you own 25% of it. Same goes for the stocks bugs you would own 25% of them. On a yearly basis you would rebalance to keep things in balance so if you had too much gold you would sell some and buy more long term bonds.

25% in U.S. stocks, to provide a strong return during times of prosperity. For this portion of the portfolio, Browne recommends a basic S&P 500 index fund such as the Vanguard 500 Index Fund Admiral Shares (VFIAX).1

25% in long-term U.S. Treasury bonds, which do well during times of prosperity and during times of deflation—or lower prices—but which do poorly during other economic cycles.

25% in cash to hedge against periods of “tight money” or recession. In this case, “cash” means short-term U.S. Treasury bills.

25% in precious metals (gold) to provide protection during periods of inflation. Browne recommends gold bullion coins.

Browne recommends rebalancing the portfolio once a year to maintain the 25% target weights.

Ray Dalio’s All Weather portfolio:

The Ray Dalio All Weather Portfolio is exposed for 30% on the Stock Market and for 15% on Commodities. You may see the portfolio has similarities to the permanent portfolio holding long term bonds and Gold. Also the low amount of stocks 30% & high amount to Government Bonds 40% is similar to our own Crest Secure.

It’s a Medium Risk portfolio and it can be replicated with 5 ETFs. In the last 10 years, the portfolio obtained a 7.18% compound annual return, with a 6.00% standard deviation. In the last 25 years, a 7.98% compound annual return, with a 6.87% standard deviation.

I think the main thing you’ll pick up is these are quite clever portfolio’s sometimes referred to as lazy portfolio’s.

When young/ish or older & more willing to take high risk, it makes sense to take more risk so you could be 100% in stocks/equities but when you get close to retirement and you won the game, hit your number (so to speak) it makes sense to take some chips off the table and add uncorrelated assets to the mix. You will still keep a large stocks/equities position but you will hold other assets like say Gold, REIT’s, Long term bonds/gilts or preferred shares. A quote that perfectly sums this up from Ray Dalio himself is:

“Making a handful of good uncorrelated bets that are balanced and leveraged well is the surest way of having a lot of upside without being exposed to unacceptable downside.”

So a younger/ish or high risk older persons portfolio will look more like this:

100% US Equities if a US resident or if you’re bullish on the USA or if you’re from the UK or New Zealand a 100% Global equity fund will fit the bill.

But will likely morph into something like this (Golden butterfly portfolio below) about 5 to 10 years away from retirement to avoid a big crash and the value of your portfolio plunging and to keep things more stable as you’ll be relying on the income it generates.

Finally while no one holds a crystal ball on what the market will do in the future there are a few things you can do to help you be successful while investing in your future.

Do not try and time the market. Waiting for a crash to buy in at the bottom is a mistake. The last big crash was 2008, market went down a little in March 2020 during the pandemic but wasn’t as major as ‘08. Every year some online Finance guru will predict it’s coming! The market crash is coming! I’ve been hearing it yearly since 2016 they’ve all been wrong. Also even if the market tanked how low will it go? Are we at the bottom yet? Could it go down even lower? You won’t really know, you’ll be guessing. What I prefer over timing the market is time in the market. Ignore the noise just keep buying in on a monthly or yearly basis don’t even look at your portfolio and you will do well long term.

Behaviour in investing is everything like constantly checking your facebook/twitter feed there are people just like me that check their portfolio daily this is so pointless. A much better way is to check it every 6 month’s to a year. The more you check the more tempted you’ll be to do something silly like sell your fund and buy some thing else. This will lead to your broker becoming rich as they make money off your trading activity (transaction fees).

Having a written investing strategy manifesto can help you stick to your plan in the hard times when you are tempted to do something silly like sell or buy something new.

Watching out for fee’s which is definitely something you can control. Some providers charge a percentage fee. The more your plan grows in value the more this percentage fee rises. On smaller amounts this hardly feels so bad but the larger your pot grows the more you will notice. The alternative is looking at providers that capp their charges or have a fixed annual charge so no matter if you have 10k or 1 mill (Someday) you will still only pay say for example £90 per annum. Again choosing a good broker with fair charges is the key to this.

Always choose passive funds Vs active funds. I think there was a study done that said 70% or 80% percent of passive funds beat actively managed funds which usually are more expensive as well.

Focus on Small wins:

I think there is a few small wins most people can make before taking on risky alt crypto coins or investing in the next big stock company (Winning Horse, to compare to horse racing) These can be different for each individual and just a guide not a rule as we all focus on different things. I do think it’s important to have fun in our lives so if technology or holidays or good nights outs is your thing spend on your passions but simultaneously take care of your personal finances to set you up for a good future your future self deserves. An investment today is like a present to your future self.

1. Contributing to your workplace company pension up to the company match, as seen above.

2. Consider building up an emergency/murphy’s law or to put a positive spin on it an opportunity fund (some prefer to call it an opportunity fund) as a safeguard for any emergency/opportunity that may come up and this needs to be easily accessible so preferably in a savings account in cash. An emergency is not a holiday or a pizza delivery 🙂

3. If you have any consumer debt ie high interest credit cards or personal loans to aim to pay these off as fast as possible as this will save you a ton in interest and is a guaranteed return and much better then gambling on crypto speculation hoping to strike it rich.

4. Not waste money on lottery tickets, look at the odds. It’s a waste of money at least buy something real like a cup of coffee at least you get to experience that or consider taking a friend or partner out for a nice meal.

5. You could pay a little extra on your mortgage say 10%. This again will save you on interest and help you pay off your mortgage a few years earlier. Then if anything extra you could return to filling up your pension for long term savings or ISA if you need earlier access.

6. Give to charity – probably should be number 1. This doesn’t have to be monetarily but can be volunteering your time. This not only makes you feel great but can change someones life and make the world a better place. Some may say like on a plane put your safety gear on first before attending to others. So even if your not in a position to give today you may be tomorrow when your financial position becomes more positive/more free time situation changes.

I hope this guide is helpful and peaks your interest in investing even a small amount can make a huge difference to you life down the road. I’ll finish on the below quote: “The best time to plant a tree was 20 years ago. The second best time is now.” – Chinese Proverb

Put together by Pension Way and a lot of help from the great sources below:

References:

Portfolio Charts https://portfoliocharts.com

Vanguard https://www.vanguardinvestor.co.uk

Monevator Blog UK https://monevator.com

Bogleheads Forum https://www.bogleheads.org/forum/index.php