Salary exchange (can also be known as salary sacrifice or smart pensions) is a very tax-efficient way to pay into your workplace pension.

In simple terms, it’s an agreement between the employee (you) and your employer where you exchange part of your gross salary for a pension contribution. It can also work the same for workplace benefits you may get like a company car, childcare voucher schemes and cycle to work schemes.

The main advantage is you pay less tax, and both you and your employer pay less National Endurance Insurance Contributions (NIC). Win! Win! This is mainly the result of the fact your salary is reduced before tax and NIC get taken.

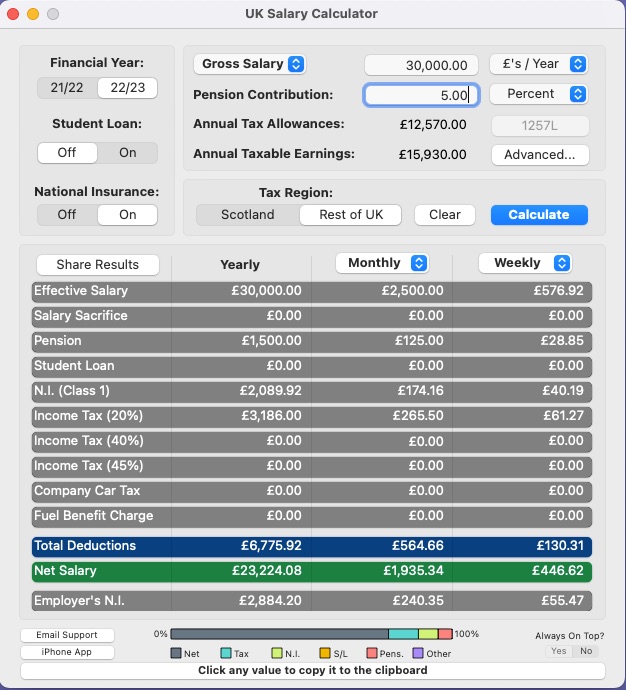

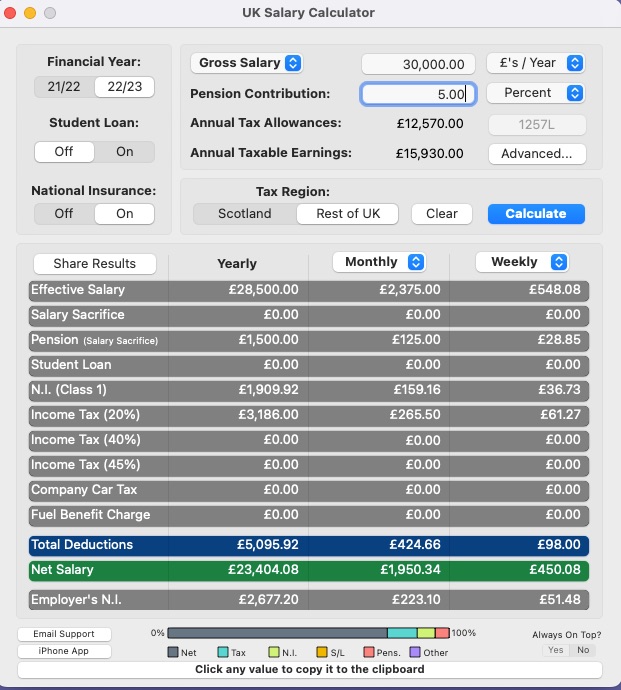

To make this point I have 2 different comparison screenshots of the UK salary calculator showing the monthly/yearly differences between net relief at source and salary sacrifice to your wages. To keep things simple I have based both examples on a 30k salary with a 5% employee pension contribution.

The 1st screenshot is the traditional Net pay and the 2nd screenshot is a Salary Sacrifice type.

Vs:

This example I hope proves monetarily speaking you do not lose any money by opting for salary sacrifice which is a great option for most pension savers in the UK.

*Things to consider before opting in to this salary sacrifice agreement or at least think about are the following:

You won’t be able to exchange part of your salary if it drops you you below the National Minimum Wage or National Living Wage.

As your salary lowers when you agree to exchange part of it, it may affect your entitlement to other benefits like statutory sick pay. Might be worth giving your companies HR dept for more information on this.

The rules of salary sacrifice may change in the future so if unsure if it’s right for you it may be wise to speak to a qualified financial adviser.

If you are a higher rate taxpayer you could definitely benefit from higher tax and NIC savings.

When applying for a mortgage ensure you check with your mortgage broker or mortgage lender if salary exchange may impact how much they can lend you. Used to be more of an issue before but less so these days, still important to check.

When you take into account the tax and NIC savings as well as some employers may choose to put back into your pension the savings on NIC as well as the company match (free money) this can make Salary sacrifice very advantageous. Although I do believe it is important to make sure you meet your long term goals through a pension. It may be tempting to fund a salary sacrifice pension to the hilt but please ensure you are also considering contributing to other great vehicles like the Stocks and Shares ISA also, especially as you as you may need instant access to these funds in the short to mid-term. As well as keeping some cash in the bank ideally 6 months to 1 years expenses/bills for a rainy day or opportunity fund (as I prefer to coin it).

Ultimately, the salary sacrifice is a great way to save into your workplace pension and if you like something that is tax and NIC efficient, automated and is set and forget hard to beat. Remember a salary sacrifice pension despite the lock up of access is a great way to save tax and NIC efficiently and build a decent pot for your future.